Following advice and a risk register circulated to members on the consequences of leaving the EU, the BWF staged at Members' Day a debate on what this means for our future.

The Debate:

David Pattenden, the outgoing BWF President already expressed that now was the time to seek opportunity in the changing economy and that the BWF are already working with our umbrella bodies and key partners to understand how the exit process will work. In the months ahead BWF will be keeping members informed and working to prioritise regulatory and market issues, forming a clear position on what the desired outcome on each is and using the organisation’s influence to drive positive change for a sector that does much to deliver skilled employment, wealth to the UK economy.

This set the scene for the Brexit Debate with Shadow minister for small business Bill Esterson, Construction Products Association economist Noble Francis, Build UK chief executive Suzannah Nichol and Timber Trade Federation director David Hopkins joining Iain McIlwee, BWF CEO.

Bill Esterson opened with the words “The referendum decision must be honoured,” said Mr Esterson. “We are where we are and we have to look at the best relationship we can secure with Europe. He pointed to the easing in austerity and the need to see investment in infrastructure and construction which will help the joinery sector.

Prof Francis spoke of the need to be cautious, pointing to the short-term effects of the Brexit and the potential to delay projects. He added, however that Brexit is unlikely to actually happen until 2019. Despite housebuilder shares being hit on the stock market he did not think there would be a collapse in the housing market although support to maintain investment levels was important. Large new commercial projects may be impacted next year, due to a 12-18 month lag between orders and activity, however, the long-term fundamentals of construction are good. He noted that there is much the government can do to boost the sector and offset the impact.

Whilst there was some concern regarding the initial impact, with one manufacturer pointing to a drop in orders, others confirmed that they believe the vote to be an opportunity, with the building industry being presented with a blank piece of paper for the future. One participant noted clients were starting to ask questions such as whether his company’s windows were British-made, while a staircase manufacturer at the debate said new enquiries had dropped following the vote.

Performance Timber Products Group chairman Roy Wakeman from the floor that there was no need to worry, as more than 60 million people in the UK would still buy and consume products following the Brexit decision. “Let’s get on with it,” he urged.

The debate concluded with a discussion on skills and the need to develop the skills base in the UK to ensure the industry could move forward in a resiliant way and take full opportunity of change.

Key areas of focus moving forwards:

EU Regulations

At present a key part of BWF focus is how EU Regulations, Legislation and Standards relating to our industry will be affected. “Can we forget about complying with CPR now UK has voted to leave the EU?” is a common question. Also, there’s the question of how standards-setting works in the future and will UK still be able to influence or need to influence European Standards and indeed will as scenario exist whereby we will have more control over our own national rules and standards.

How much or how little of EU Regulation the UK will continue to adopt is intrinsic to our Article 50 negotiations. Should we wish to, unpicking the links will be a time consuming process as EU Regulations and UK Law are intrinsically linked.

In each Member State, EU Regulation is translated into the national legislative framework (e.g. UK Construction Products Regulation sets the framework for enactment of the EU Construction Product Regulations and CE marking in the UK). So, if the UK government decides it wants change after the date of secession, provisions will have to be made to repeal or amend legislation and any linked acts. The Construction Products Regulation, Employment Laws, the EU Timber Regulations, Alternative Dispute Resolution Regulations, Health and Safety and Energy Performance of Buildings and other environmental legislation, such as the Circular Economy, all fall into this trap.

In each Member State, EU Regulation is translated into the national legislative framework (e.g. UK Construction Products Regulation sets the framework for enactment of the EU Construction Product Regulations and CE marking in the UK). So, if the UK government decides it wants change after the date of secession, provisions will have to be made to repeal or amend legislation and any linked acts. The Construction Products Regulation, Employment Laws, the EU Timber Regulations, Alternative Dispute Resolution Regulations, Health and Safety and Energy Performance of Buildings and other environmental legislation, such as the Circular Economy, all fall into this trap.

EU Timber Regulation is almost certainly here to stay, on the whole it has been welcomed by the industry, but the CPR less so and with products currently being absorbed (e.g. the CE Fire Doorsets) that may necessitate significant investment we need an early indication.

EU Timber Regulation is almost certainly here to stay, on the whole it has been welcomed by the industry, but the CPR less so and with products currently being absorbed (e.g. the CE Fire Doorsets) that may necessitate significant investment we need an early indication.

At this stage the UK remains a Member State and moving forwards it is assumed that UK will want to align with CE marking rules (CPR) to support trade activities and that some or all aspects will be reflected in UK law (there will not be a void created), but there is no clear steer yet. At present this regulation binds all countries in the European Economic Area, not just the EU (so includes Switzerland, Norway, Iceland and Liechtenstein). Other considerations would be that if Scotland remained and England withdrew, you would need to CE Mark to sell into Scotland.

BWF has been in contact with key Civil Servants and at this stage they can only re-iterate that currently as a Member of the EU we are bound by these regulations and future requirement will depend on how Article 50 is eventually evoked.

A significant factor here is that after the age of austerity, the Civil Service itself is diminished. Timings and priorities will be set against resource and the timeline is uncertain.

In this period of hiatus, BWF is seeking clarity, but will also be asserting that companies should be protected through the period of uncertainty and suitable extensions/exemptions of prosecution given if compliance does not hit target dates.

Standards

Standardisation in Europe is based on the CEN system. CEN is the acronym for the European Committee for Standardisation, an association that brings together the National Standards Bodies of 33 European countries. It is the main standards organisation recognised by the EU and by EFTA (the European Free Trade Association) responsible for developing and defining voluntary standards at a European level, but it is not in itself an EU committee.

BSI is the body that represents the UK in the CEN system and BSI’s membership of CEN need not necessarily be affected by the UK’s decision on EU membership. That’s because CEN represents a European wide approach to Standards rather than being exclusive to EU Member States. BWF anticipates that our industry will continue to be able to influence European Standards development, where appropriate. It seems likely that our standards will, in the large part, continue to mirror EU equivalents.

Other Impacts

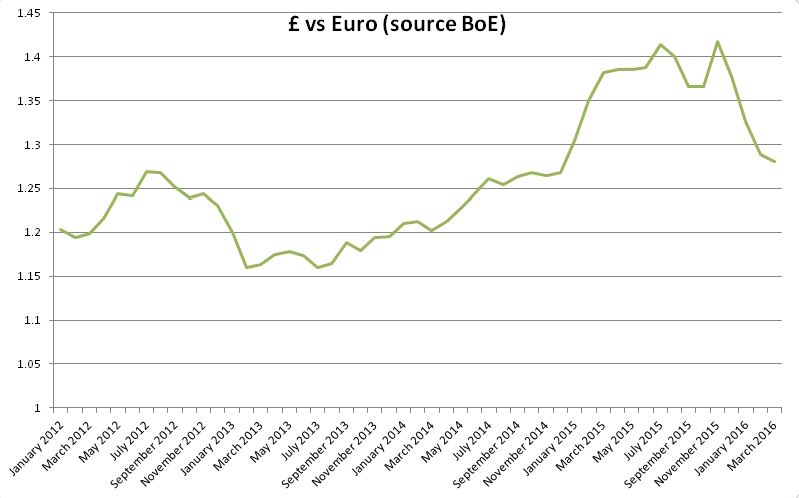

The impact of currency fluctuations

One important impact has been the rapid decline in the value of Sterling against the dollar and euro with related volatility in other currencies. This appears – on the surface at least – to be stabilising and some ground has been regained along with climbs in the FTSE 100 and FTSE 250. With heavy reliance on imports this will have an impact on material and potentially other component prices. Members are advised to keep a watchful eye on currency rates to ensure that they are well armed for any negotiations. It is useful to consider how your suppliers hedge risk of fluctuation to help understand when any impact may bite.

One important impact has been the rapid decline in the value of Sterling against the dollar and euro with related volatility in other currencies. This appears – on the surface at least – to be stabilising and some ground has been regained along with climbs in the FTSE 100 and FTSE 250. With heavy reliance on imports this will have an impact on material and potentially other component prices. Members are advised to keep a watchful eye on currency rates to ensure that they are well armed for any negotiations. It is useful to consider how your suppliers hedge risk of fluctuation to help understand when any impact may bite.

The impact on markets

Clearly it is very early to call and indeed the timing of the vote means that there will be little to go on in terms of GDP figures for around 3 months, so there will be much speculation.

The biggest area of influence on our sector is Housebuilding and the early dent in Housebuilder shares is not a positive indicator. However, the housing market is a complex and multi-faceted market and fundamentally there remains an inherent under-supply in the UK and a commitment from Government to drive activity to address this. So the luxury London market may suffer from investment drops (although a weakened currency may offset this in part), but it seems unlikely that there will be a wholesale collapse.

The high end market, particularly in London is viewed as more vulnerable, however this market had in all probability started to peak already. Decline is not, however, certain as currency fluctuations may provide a balancing effect making investments appear more

The other most significant factor is confidence. Our own State of Trade Survey will give an early indication, but below from the Construction Products Association (CPA) sums up just how difficult it is to look ahead with certainty:

The UK economy and construction were both adversely affected by uncertainty prior to the EU referendum on 23 June and, as a result, we saw reduced confidence in construction in the first half of the year, undermining our forecasted 3% growth for 2016. This uncertainty has only heightened following the result of the vote to leave the EU, but work is continuing on current projects. For the rest of 2016 there are still a large number of projects underway across the industry, especially in the key sectors of private housing, commercial offices and infrastructure. In 2017, activity will primarily be affected in sectors with shorter lead times, such as housing and industrial.

As the policy agenda emerges we will work closely with our members to shape the future of the construction forecasts, and we will provide insights on the economy and supply chain to help companies to plan for the future.

In the short-term, the increased uncertainty will lead to an impact on the signing of contract awards and the financial viability of projects due to project finance availability, borrowing costs and the inflationary impacts of rising import costs, from the weakness of the pound. In the medium-term, there may be constraints on growth due to lack of skills availability from the EU and potentially further afield. In the longer-term, the current uncertainty may have a considerable impact upon manufacturing investment in the UK. To reduce the impact of this uncertainty, it is vital that political leadership is quickly established and a plan is implemented to increase confidence and provide stability to the UK economy.

The CPA was due to have its Construction Industry Forecasting Panel on 19 July, with publication of the summer edition on 15 August. We now believe this will be too early to take into account the full impacts of the referendum results and, as a consequence, CPA has decided to instead produce a guide for companies which will cover the following;

1. Use the CBI/PwC macroeconomic scenarios to model what the possible outcomes for the different construction sectors could be. We will utilise the type of fan charts used by the Bank of England that highlight the upper and lower bounds, reflecting the uncertainty around the scenarios.

2. List the key assumptions for each scenario and major risks to each sector.

3. Look at developing a model which our member companies can use to input their own assumptions and customise for their major markets.

4. Provide an outline of short and medium term policy and taxation measures that will enhance or undermine the growth of the sector.

We anticipate that we will publish this work on our website (rather than in hard copy) in September, when there should be less political uncertainty.

Looking ahead, we will aim to update this in the autumn, following the meeting of the forecasting panel. We anticipate that following government’s expected Pre-Budget Report towards the end of the year and by the time of our winter forecast in January 2017, we can once again provide a more robust set of data for 2017-2020.

Conclusion

On the 23rd June the British public voted for change and this will echo through Westminster, the Markets and Europe. There are risks and opportunities aplenty and only with the gift of hindsight will we fully understand the significance.

One thing you can rely on is that BWF will be here, trying to make sense and ensuring that wherever we can this change is positive for the UK Woodworking Industry.

In each Member State, EU Regulation is translated into the national legislative framework (e.g. UK Construction Products Regulation sets the framework for enactment of the EU Construction Product Regulations and CE marking in the UK). So, if the UK government decides it wants change after the date of secession, provisions will have to be made to repeal or amend legislation and any linked acts. The Construction Products Regulation, Employment Laws, the EU Timber Regulations, Alternative Dispute Resolution Regulations, Health and Safety and Energy Performance of Buildings and other environmental legislation, such as the Circular Economy, all fall into this trap.

In each Member State, EU Regulation is translated into the national legislative framework (e.g. UK Construction Products Regulation sets the framework for enactment of the EU Construction Product Regulations and CE marking in the UK). So, if the UK government decides it wants change after the date of secession, provisions will have to be made to repeal or amend legislation and any linked acts. The Construction Products Regulation, Employment Laws, the EU Timber Regulations, Alternative Dispute Resolution Regulations, Health and Safety and Energy Performance of Buildings and other environmental legislation, such as the Circular Economy, all fall into this trap.  EU Timber Regulation is almost certainly here to stay, on the whole it has been welcomed by the industry, but the CPR less so and with products currently being absorbed (e.g. the CE Fire Doorsets) that may necessitate significant investment we need an early indication.

EU Timber Regulation is almost certainly here to stay, on the whole it has been welcomed by the industry, but the CPR less so and with products currently being absorbed (e.g. the CE Fire Doorsets) that may necessitate significant investment we need an early indication.