We have now responded to the HMRC consultation on removing the zero VAT rating on approved alterations to listed buildings. There has been much discussion on this since it appeared in the 2012 Budget announcement and we thank you for feeding your views back to our team.

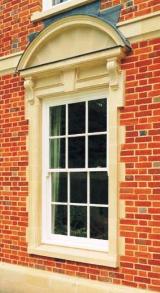

Our position is that the government should reverse the proposed measure, which would add 20 per cent to the cost of alterations approved under listed building consent and is due to come into force on 1st October 2012. We feel that given benefits that the nation would see from an improvement in the fortunes of the construction sector, it seems perverse that the HMRC would want to implement a measure that would actually lead to a fall in construction activity, particularly one which would affect a number of manufacturers of quality joinery.

Our position is that the government should reverse the proposed measure, which would add 20 per cent to the cost of alterations approved under listed building consent and is due to come into force on 1st October 2012. We feel that given benefits that the nation would see from an improvement in the fortunes of the construction sector, it seems perverse that the HMRC would want to implement a measure that would actually lead to a fall in construction activity, particularly one which would affect a number of manufacturers of quality joinery.

With the measures already causing disruption to planned building projects and threatening the future of the UK’s historic buildings, the BWF joins a number of organisations in opposing the change. These include the Campaign to Protect Rural England, the Federation of Master Builders, the Heritage Alliance and the Royal Institute of British Architects. There are concerns that the withdrawal of the VAT concession would deter the sympathetic alterations that many of our historic buildings need to ensure that they can continue to be of social, cultural and economic value.

The consultation period for the measures ended on 18th May, and we have responded to policymakers with your views. You can find the consultation response letter to HMRC here.

In addition to representing your views on the removal of the zero VAT rating, the BWF will continue to support the notion that the VAT rate on all private housing repairs and improvement work should be reduced to 5 per cent.